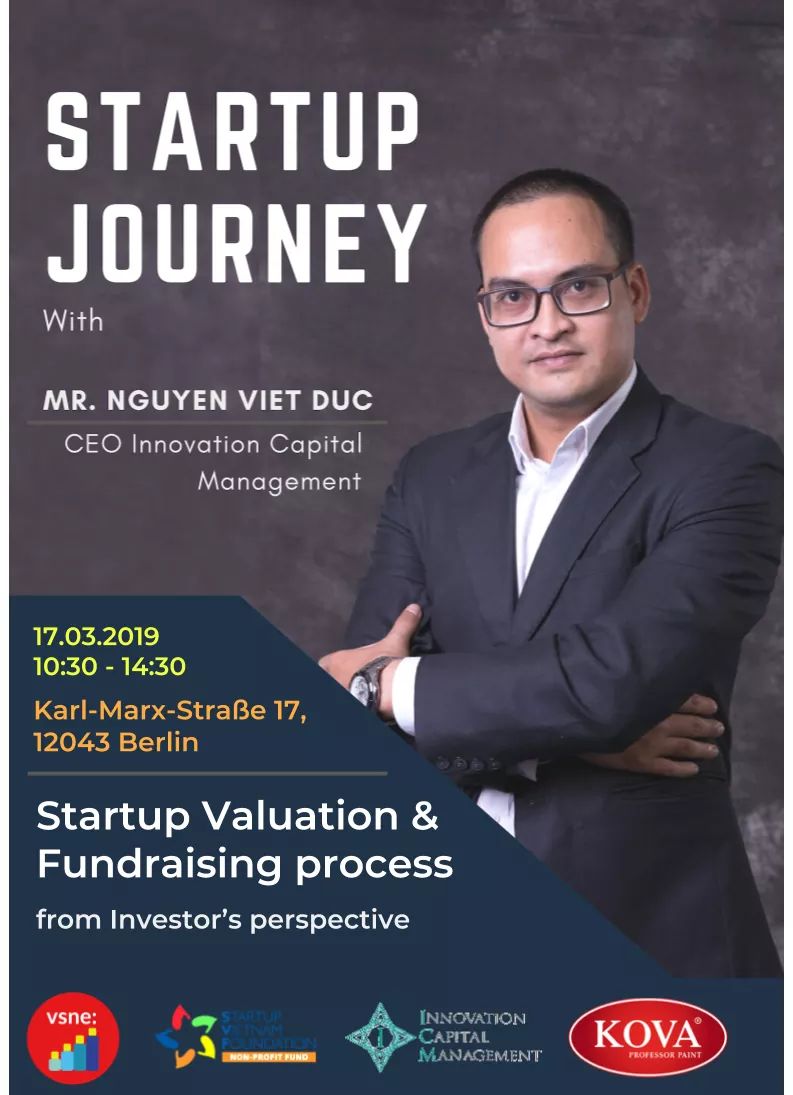

Financial and Strategic Advisory

Financial management and strategic management are the foundations of sustainable business development. Financial management ensures the efficient use of financial resources, maintaining liquidity and profitability. Strategic management sets long-term goals, helping businesses adapt and grow in a competitive environment. This combination optimizes resources and creates sustainable competitive advantages.

M&A Advisory Assisting SMEs in mergers, acquisitions, or selling their businesses Valuing businesses to determine a fair price Negotiating and structuring deals to ensure favorable terms for clients

Restructuring Advisory Helping businesses restructure their operations or finances to improve financial health Proposing strategies such as debt restructuring, asset sales, and operational changes

Financial Analysis and Planning Offering strategic advice to help businesses develop and expand their markets Supporting in building business plans and executing growth strategies Assisting SMEs in long-term and short-term financial planning Providing financial analysis to identify opportunities and risks

Read moreFinancial and Strategic Advisory

Financial management and strategic management are the foundations of sustainable business development. Financial management ensures the efficient use of financial resources, maintaining liquidity and profitability. Strategic management sets long-term goals, helping businesses adapt and grow in a competitive environment. This combination optimizes resources and creates sustainable competitive advantages.

M&A Advisory Assisting SMEs in mergers, acquisitions, or selling their businesses Valuing businesses to determine a fair price Negotiating and structuring deals to ensure favorable terms for clients

Restructuring Advisory Helping businesses restructure their operations or finances to improve financial health Proposing strategies such as debt restructuring, asset sales, and operational changes

Financial Analysis and Planning Offering strategic advice to help businesses develop and expand their markets Supporting in building business plans and executing growth strategies Assisting SMEs in long-term and short-term financial planning Providing financial analysis to identify opportunities and risks

Xem thêm